The acquisition of ordinals and BRC-20s, if not previously obtained during the earlier part of this year, is unlikely to occur in the foreseeable future. The current state of technology exhibits certain imperfections, particularly in user experience and product development.

The bear market has hurt BTC network collectibles, resulting in low trade volume and a lack of shine, preventing the sector from attracting the same level of attention as other markets. However, it is evident that Bitcoin possesses significant untapped potential, and it is imperative to acknowledge that our collective sentiment towards its prospects may need to be more adequately optimistic.

NFT Sales Plummet

Usual BRC-20 token sales have been on the decline this fiscal year, and this trend is mirrored by a significant drop in the overall number of NFTs connected to both blockchains. Bitcoin sales have dropped dramatically, from a high of US$196 billion in May to a low of US$11.9 million in August, a drop of 93 percent.

The peak value of Ethereum in February 2023, which amounted to US$969 million, experienced a significant decline of 73% by August, reaching US$226 million. Similarly, Solana witnessed a decline of 77%, while Polygon experienced a comparatively lesser decline of 49%.

Various individuals have cited similar figures. However, our reservations regarding the analogy above are particularly within this highly conjectural market characterized by speculative bubbles surrounding emerging technologies. The emergence of Bitcoin’s ordinals and BRC-20s transpired in the current year, contributing to a sales bubble akin to the initial NFT surges witnessed by other blockchain networks in the preceding year.

When examining the historical peak of monthly sales for various blockchains and juxtaposing them with the data from August 2023, it becomes evident that Bitcoin’s decline of 93% is comparable to that of other blockchains. The value of Ethereum has experienced a significant decrease of 95% from its peak of US$4.9 billion in January 2022. Similarly, Polygon and Solana have also witnessed a substantial reduction of 90% from their respective peaks in the previous year.

The significance of this comparison is widely acknowledged, as is the indisputable prominence of Bitcoin in terms of its global adoption and security measures. The criticisms above levied against Bitcoin, namely its absence of smart contracts and the perceived inadequacy of its wallets, marketplaces, and related infrastructure, resemble the early stages of Ethereum’s development. Ethereum, too, initially needed more intelligent contracts and encountered challenges with marketplaces such as OpenSea, which occasionally experienced prolonged unresponsiveness. Bitcoin currently resides in a position that aligns precisely with its intended trajectory, slightly surpassing the halfway mark of its predetermined roadmap.

Upon resolving the quality concern, the endorsement and subsequent integration of non-fungible tokens (NFTs) is anticipated to be spearheaded by prominent industry figures, potentially including the esteemed artist Beeple.

Attention to Bitcoin NFT Remains Significant

In the preceding week, notable developments within the Bitcoin ecosystem have provided compelling evidence of heightened regard for Bitcoin among prominent figures in the non-fungible token (NFT) realm.

The On Chain Monkeys team has decided to transfer their complete 10k edition collection from Ethereum to Bitcoin. The purpose behind the requested modification is to adopt a more formal and impersonal tone to convey a sense of The significance of the blockchain upon which one resides is inherently implied by its nomenclature.

Without question regarding the enduring nature of Bitcoin, OCM perceives a favorable prospect to establish itself as the foremost entity in the realm of Personal Finance Platforms (PFPs) within the Bitcoin ecosystem. Consequently, OCM is wholeheartedly committing its resources and efforts towards this strategic maneuver.

Yuga Labs, the company behind the popular boredom ape NFTs and the alternate metaverse, has made a name for itself in the Bitcoin community with its NFT series. Twelve weekly ciphers have been initiated, centered around the TwelveFold art.

The individual who successfully unravels each puzzle first will be awarded 0.12 BTC, equivalent to approximately US$3,000. The significant investment made in the prominent blockchain platform indicates the profound conviction held by the stakeholders regarding the paramount significance of said chain.

The technological advancements in Bitcoin are undergoing enhancement, as a novel attribute known as parent-child inscriptions is being integrated into the existing inscription framework. The proposed solution aims to establish a universally applicable protocol for integrating collectibles into blockchain technology. Doing so sets a precedent for seamless connectivity while establishing a solid foundation for implementing collections, lineage, and potentially unexplored conceptual notions.

Technological advancements are steadily progressing, accompanied by a burgeoning community, as diligent builders diligently address the peripheral imperfections surrounding the fundamental tenets of the inscription movement. Bitcoin and its associated collectibles possess enduring qualities that contribute to their long-term viability. Please allocate an appropriate amount of time for your entry into the Bitcoin ecosystem, as it is a stable and enduring entity.

Check Out the Graphs

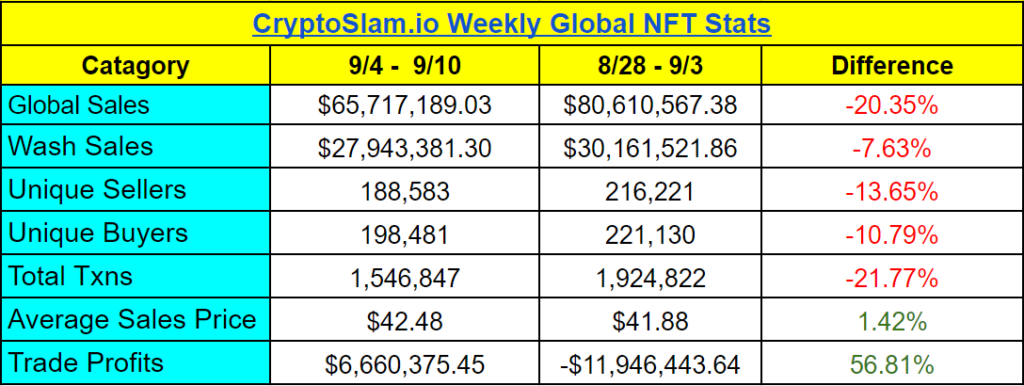

Global NFT sales reflect a notable decline, reminiscent of the levels observed in May 2021. Furthermore, the composition of buyers, sellers, and transactions resembles the period above.

The current observation pertains to the potential regression of our valuation within the range of US$30 million to US$55 million, thereby reinstating the circumstances reminiscent of February 2021, a period preceding the complete inflation of the market. The anticipation lies in determining the current valuation of our floor and the extent to which collectors’ appraisal of said assets drove the trading activity over the past two to three years.

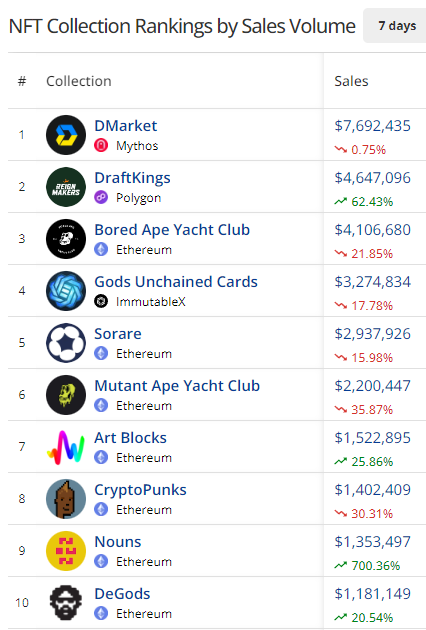

DMarket has again shown outstanding success, rising to the top of the rankings for the week’s collections. Sales of game skins earned an astounding US$7.6 million in income, surpassing those of sports fantasy items to collect, gaming resources, PFPs, and artwork combined.

The sales of Nouns are experiencing a significant increase. However, this development could be better. The decentralized autonomous organization (DAO) has undergone a bifurcation, resulting in an advantageous proposition for token holders to divest their Noun non-fungible tokens (NFTs) back to the DAO at a significantly higher valuation than prevailing rates observed within secondary markets.