How will the coming split of Bitcoin affect the price of BTC?

Why will Bitcoin’s instability stay in the double digits for many years?

The individual known as Dan Rosen, who holds the position of Associate Director of Derivatives at Luxor, possesses a comprehensive understanding of the subject matter and is equipped with the necessary knowledge and expertise to provide insightful responses.

When examining the trajectory of any maturing asset, it is imperative to acknowledge the inherent nature of experiencing periods of heightened volatility during its initial launch. By drawing a parallel between Bitcoin and the tech stocks that emerged in the early 1990s, such as Apple and Google, one can discern the astronomical levels of volatility that characterized their respective journeys.

In the realm of digital currencies, Bitcoin experienced a period of extraordinary price fluctuations several years ago, reaching levels of volatility that can only be described as astonishing. During that time, the price of Bitcoin exhibited a range of changes spanning from 70% to a staggering 100%. As time progresses, we can observe a gradual decline in this phenomenon, a trend poised to persist as the asset in question gains further traction as a viable investment option.

Moreover, the forthcoming introduction of an exchange-traded fund (ETF) is expected to solidify and perpetuate this trajectory. In the foreseeable future, it is plausible to anticipate the emergence of an asset class with an annualized return of 20% or even lower, potentially within a time frame of approximately four to five years.

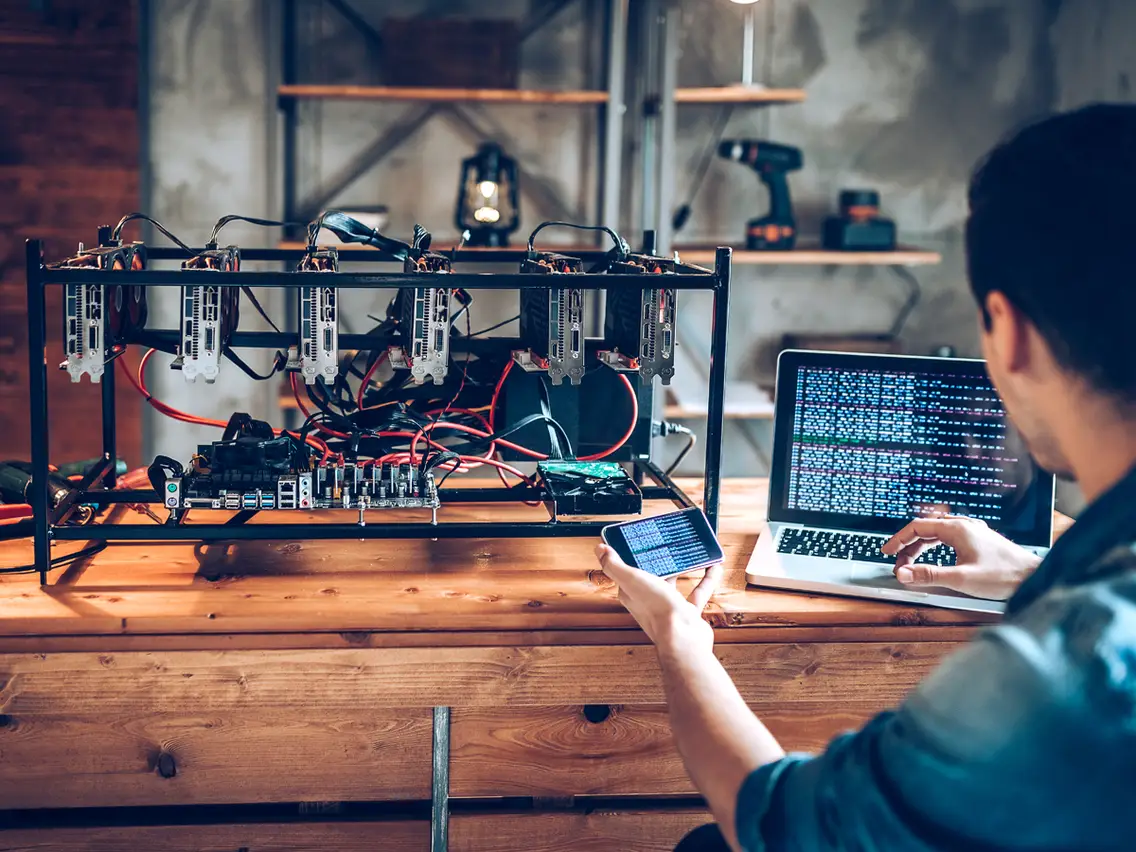

Throughout the annals of history, it has been observed that miners, in their pursuit of extracting valuable Bitcoin rewards, have been confronted with a shortage of viable avenues to mitigate the inherent uncertainties that permeate their operational endeavors. The hash rate derivatives offered by Luxor serve as a crucial addition to the existing infrastructure within the cryptocurrency mining industry.

These derivatives enable miners to effectively manage and mitigate their risk exposure to fluctuations in price. By providing a mechanism for hedging, Luxor empowers miners to navigate the dynamic nature of the market with greater confidence and stability. In their profound capacity, derivatives bestow upon miners the invaluable ability to anticipate and secure forthcoming revenue amidst the tumultuous throes of unforeseen volatility that may impede the seamless functioning of their operations.

Macroeconomic Factors are Still Influencing the Price of Bitcoin and Its Miners

About the macroeconomic factors and their potential implications on the price of Bitcoin as well as its miners, Rosen has expressed his perspective. It is becoming increasingly evident to the market that attaining the 2% inflation target rate is unlikely to occur shortly.

Consequently, the market is beginning to factor in the probability that inflation will persistently hover from 2.5% to 3% over an extended period. Simultaneously, it is worth noting that the U.S. dollar continues to retain its status as a refuge for risk-averse investors, exerting a discernible influence on equity markets and engendering overarching macroeconomic challenges. Consequently, these dynamics result in a devaluation of assets denominated in the U.S. dollar.

In light of the prevailing unhappy state of the economy, Rosen maintains a steadfast belief:

In the context of the forthcoming halving event and the prevailing macroeconomic conditions, it is plausible to consider the possibility of Bitcoin’s price not reaching the coveted six-figure mark in the immediate aftermath. However, it would be partially unexpected to witness a decline in the coming six months, owing to the influence of broader economic factors. Subsequently, one could anticipate a more robust resurgence in the value of Bitcoin.