The apparent reluctance to extensively explore and deliberate upon the significance of energy in various economies is a notable phenomenon worth examining. Furthermore, what factors contribute to the prevalence of excessive politicization and division within the industry? Tribalism within the energy sector can be considered an extra distraction, devoid of substantial value or significance. A lack of logical coherence characterizes the inherent nature of this statement. It is imperative to maximize energy generation while ensuring the preservation of economic stability, thereby enabling the continuous functioning of societal mechanisms. What are the steps required to attain such a formidable objective?

The Straightforward Commercialization of Power Generating

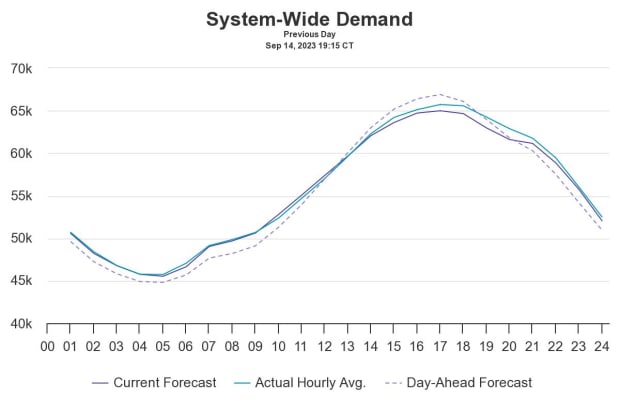

One concern that arises is the inherent volatility in the power demand. The observed phenomenon exhibits a lack of consistency over a given day and even more so over a year. The volatility above extends its influence to the diverse energy forms utilized by economies that encounter seasonal climate fluctuations or encounter limitations in accessing a wide range of energy sources.

The Path Forward for Energy

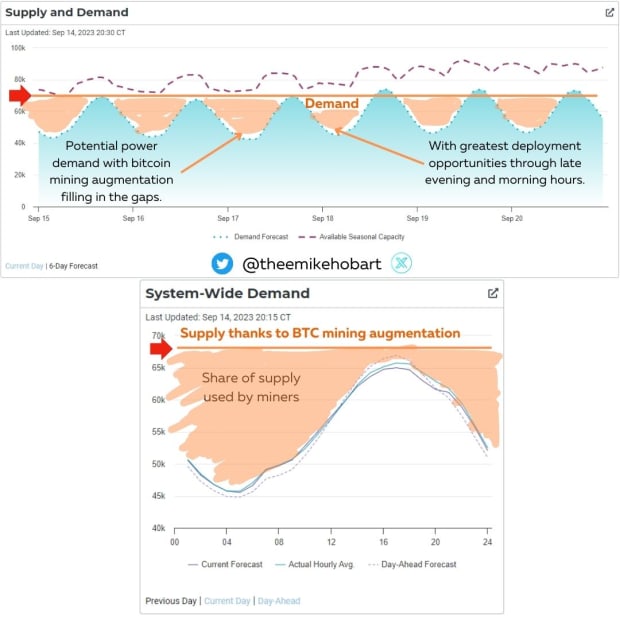

Is there a method to mitigate the inherent fluctuations in demand, enabling energy producers to sustain a consistent operational pace while ensuring a dependable power supply to accommodate societal variations?

Affirmative confirmation has been ascertained. The achievement of this objective can be realized through Bitcoin mining. Bitcoin mining can be employed as a means to mitigate the disputes among various energy generators. Individuals are entitled to engage in the competitive pursuit of hash rate and aspire to acquire the highly coveted subsequent bitcoin subsidy allocation on the condition that they consent to divert their power supply to the societal power grid during exigency.

This practice has demonstrated its efficacy in various occurrences and situations within the Texas ERCOT system and Georgia. The extent of the power-generating capacity of the operation directly correlates with its ability to meet societal demands while maintaining profitability through bitcoin mining. One notable aspect is that Bitcoin exhibits indifference towards the origin or sourcing of energy, as it seeks to acquire power from all available sources.

The rapid expansion of energy generation and distribution infrastructure can be justified by the perpetual and highly competitive demand for energy. The order in question serves as the buyer’s primary and ultimate choice. This requirement can be fulfilled by procuring energy resources at the most cost-effective rates or, alternatively, by augmenting existing operations to enhance productivity and optimize efficiency. All strategies can be considered viable options when employing this particular approach. The proposition of offering a responsive solution to the grid, capable of mitigating fluctuations in the overall demand curve, represents a groundbreaking development.

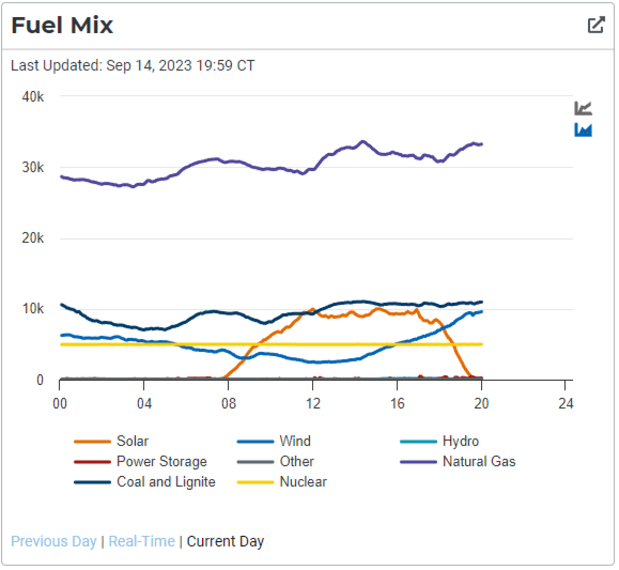

A system that exhibits a well-balanced nature would ideally demonstrate a consistent and uniform demand profile, akin to the visually depicted line representing the supply of nuclear power (yellow) above. When there is a fluctuation in natural demand, as shown in the Figures, it becomes imperative to have a versatile demand source that can effectively bridge the gap. A load capable of automatic shutdown responding to exceeding societal demand forecasts is essential. This load should offer significant operational enhancements and generate substantial revenues, making it highly desirable once circumstantial demands are met, facilitating prompt reactivation.

The activities of Bitcoin miners in ERCOT and Georgia are of significant interest and relevance. The gaps are being filled. This measure also serves as a motivating factor for energy generators to maximize their production capacity. The current circumstances provide a rationale for developing operational infrastructures that can generate significantly more energy than the present demand necessitates, yet with potential utility in the future.

When the supply of electrons does not facilitate the production of a commodity, it impacts the corresponding demand. The asset above exhibits a propensity for incessantly absorbing energy in direct proportion to the amount directed towards it, in contrast to gold and oil. The commodities above exhibit inherent market dynamics that facilitate the mitigation of elevated price levels through the rationalization of augmented production during periods of high prices and diminished output during periods of low prices.

The inherent elegance lies within the intricacies of the difficulty adjustment mechanism employed in bitcoin mining. As additional computational resources are allocated to the network, and the rate of block completion accelerates, the network proportionally adjusts the difficulty level. Conversely, in instances where block generation lags, the network modulates the difficulty level. The absence of excessive production and supply saturation can be attributed to the prevailing high prices.

In cryptocurrency, mining pools serve as a collaborative platform wherein Bitcoin miners collectively join forces to reap the rewards of the Bitcoin subsidy. In the event of such an outcome, the mining pool proceeds to allocate earnings to the pool participants based on the proportionate amount of effort contributed relative to the overall pool total. This mechanism ensures a just and cooperative system of distribution. This collaborative effort among miners yields a notably enhanced level of income stability compared to individual mining endeavors.

Conclusion

Energy generators can optimize their operations by strategically implementing data centers equipped with Application-Specific Integrated Circuit (ASIC) miners. This approach allows them to capitalize on the continuous demand generated by the Bitcoin mining network.

Moreover, the fiercely competitive nature of the industry necessitates a pressing need for advancements in chip efficiency, as well as the acquisition of not only the most cost-effective energy sources but also the optimal utilization of abundant capacity that is currently underutilized. Consequently, energy producers and utilities use bitcoin mining to optimize efficiencies, enhance operational performance, and generate supplementary revenue streams.

The fundamental principles governing energy are undergoing a process of reconfiguration. Tribalism within the energy sector is expected to diminish as various producers redirect their focus towards the promising future. The individuals involved are strategically aligned to generate substantial financial gains from this endeavor.