The price of Chainlink (LINK) experienced a notable surge, surpassing $8, following Ripple’s (XRP) favorable outcome in its legal dispute with the Securities and Exchange Commission (SEC) on July 13. In contrast to numerous counterparts, the LINK token has sustained double-digit gains, solidifying its position above the $7 support threshold. Is it possible for the bullish market participants to exert further upward pressure on prices?

On August 8, the Chainlink team made an official announcement regarding a notable partnership with Coinbase. The price feeds of the former will be integrated into the layer-2 network, Base of the latter. The analysis of on-chain data examines the potential implications for the price movement of LINK in the upcoming weeks.

Chainlink Whales Are Starting to Buy Again Because of the Coinbase Partnership

A group of astute investors in the Chainlink market strategically realized gains during the initial week of August. However, it is worth noting that after the announcement of the partnership with Coinbase on August 8, there was an immediate resumption of purchasing activity.

The chart depicts the trading activity of prominent crypto entities with balances ranging from 100,000 to 1 million LINK tokens during the preceding fortnight. During the initial week of August, the entity in question experienced a reduction in its cryptocurrency assets, specifically from 121.9 million tokens to 116.74 million tickets.

However, there was a significant change in their actions on August 8, as they acquired a substantial amount of 1.7 million LINK tokens within three trading days before August 11.

Coinbase Partnership May Increase Chainlink (LINK) Price | Whales Wallet Balance Aug 2023, Santiment

Monitoring the dynamic fluctuations in Whale Wallet Balances offers valuable insights into the prevailing trading sentiment of these entities. With the current market value of LINK at approximately $7.56, large investors’ recent acquisition of 1.7 million tokens translates to an estimated value of around $12.8 million.

The significant influx of large-scale capital from institutional investors over three days indicates a positive market sentiment. Furthermore, considering the timing, the announcement of the Coinbase partnership on August 8th may have reignited the confidence of large-scale investors.

If strategic retail investors were to also participate in the bullish momentum, the LINK price could experience a potential increase of up to 20%, thus allowing it to regain the value of $9.

Chainlink On-Chain Activity Has Also Gotten a Big Boost

Moreover, Chainlink has experienced a notable surge in network activity after integrating its exclusive price feeds into the Base network on August 8th.

Based on data from Santiment, Chainlink recorded a total of 1,666 active addresses on August 6th. However, as of August 10th, there was a significant increase of 82% in dynamic wallet addresses, resulting in 3,033.

Coinbase’s partnership could drive up the price of Chainlink (LINK) | Daily Active Addresses, August 2023, Source: Santiment

The Daily Active Addresses (DAA) metric represents the collective count of network participants engaging in economic transactions within a blockchain network. As observed in the context above, a substantial surge in value indicates an escalating desire for and heightened engagement in commerce within the network.

The observed surge in network activity occurred concurrently with the public disclosure of Chainlink’s collaboration with Coinbase earlier this week.

Based on the aforementioned on-chain indicators, it can be deduced that an increasing network demand is observed among retail market participants. In conjunction with the significant buying pressure from prominent market participants, it is plausible that LINK may experience a notable surge, potentially resulting in price appreciation of up to 20% within the upcoming weeks.

Link Price Forecast: A Straight Line to $10?

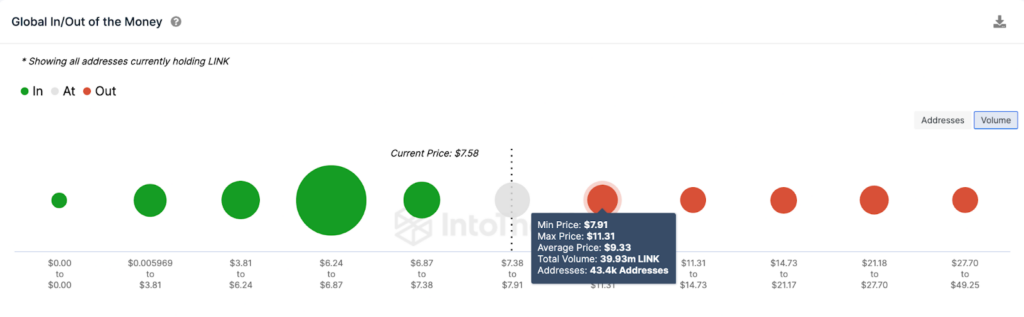

The Global In/Out of Money (IOMAP) data provides insights into the significant support and resistance levels by analyzing current holders’ critical purchase price distribution. The present analysis indicates that the $9 level represents a significant resistance zone, potentially impeding LINK’s ability to reach the desired price target of $10.

As illustrated herein, 43,400 addresses have acquired approximately 40 million LINK tokens at an average price of $9.33. In the event of their departure from their positions, it is possible to instigate a pullback.

Suppose the partnership between Chainlink and Coinbase continues to attract significant institutional investors. In that case, the LINK price may experience a notable increase of over 20%, potentially reaching a value of $10 again.

Chainlink Link (LINK) Price Prediction Based on GIOM data, August 2023. Source: IntoTheBlock

However, the bullish forecast may be negated if the price of LINK experiences a decline below the $7 threshold once more. However, it should be noted that a significant number of addresses, approximately 60,000, have acquired a total of 82 million Chainlink tokens at an average price of $7.10. This accumulation of tokens may serve as an initial level of support for the cryptocurrency.

However, the support above the level experiences a significant decline. In that case, LINK may undergo a retesting phase, potentially reaching a group of approximately $6.50, a price point not observed in the past month.