In 2023, the miners of Bitcoin experienced a significant increase in profits, but smaller players face obstacles such as the upcoming halving event.

Bitcoin (BTC) miners experienced favorable profits in 2023, particularly those who had access to cost-effective energy sources. This was particularly the case for miners who had experienced a period of decline in 2022.

Compass Mining reports that companies such as TeraWulf and Cipher Mining were able to achieve gross margins that surpassed 60%. In the initial period of 2023, well-established mining companies recorded an impressive average margin of close to 47%.

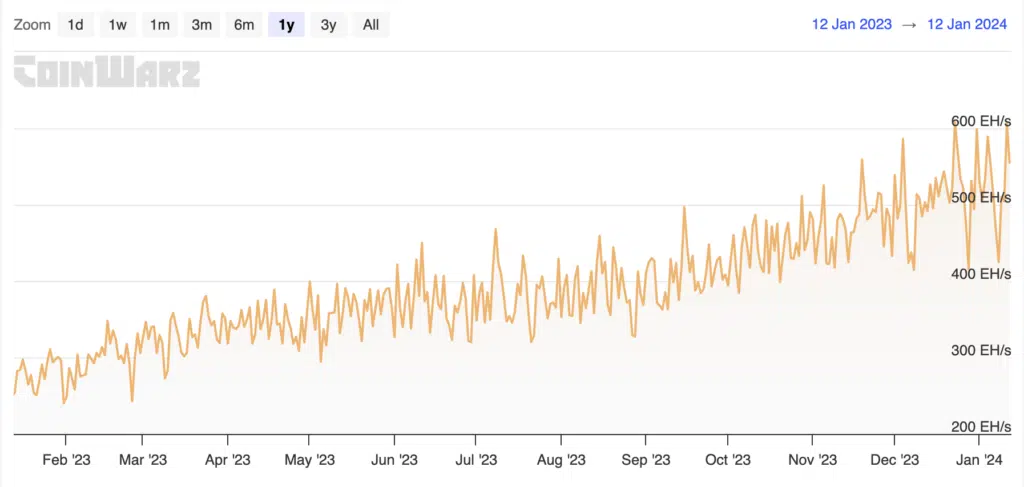

Simultaneously, the computing power of the Bitcoin network, known as its hash rate, has experienced a substantial expansion in recent months, indicating a positive market trend.

The hash rate reached an all-time high of nearly 700 exahashes every sec (EH/s) as of the 11th of January. This represents a significant increase from the 265 EH/s that it had accomplished in January 2023. This suggests that the mining environment is likely to become more dynamic and competitive.

However, the industry is confronted with challenges. The upcoming Bitcoin halving event, which is scheduled to take place in April 2024, is rapidly approaching with a great deal of significance. This event will include a reduction in the reward for each block from 6.25 Bitcoins to 3.125 Bitcoins.

Miners may have difficulty meeting their operational expenses due to the decrease in the number of newly rewarded Bitcoins for mining. This is especially true if the price of Bitcoin and the fees associated with transactions do not increase in proportion to one another.

The reduction in incentives may cause miners with lower levels of productivity to stop their operations, which may affect the entire network. Smaller miners may require a substantial increase in prices in order to maintain their profitability.

The crypto market is buzzing with optimism after the SEC gave its approval to 11 spot BTC ETF applications on Jan. 10. Bitcoin prices are expected to be impacted, which in turn will affect mining profits. Now, let’s explore these facets to gain a deeper understanding of the future of Bitcoin mining.

A Recap of Bitcoin Mining in 2023

2023 was a significant year for Bitcoin mining, characterized by numerous accomplishments and advancements.

Unprecedented Earnings and Hash Rate

For Bitcoin miners, December 2023 was an exceptionally fruitful month, surpassing even the market’s peak in November 2021. Bitcoin miners achieved this result.

An impressive 21.75 percent of the mining rewards came from transaction fees, which were primarily driven by inscription activities. A total of 36,657 BTC was collected from mining rewards.

During this period, the average price of Bitcoin on the market remained stable at or above $42,000, reaching a high point of approximately $44,000. The surge in the market caused the total revenue from mining to surpass $1.5 billion in December 2023, marking the highest figure since the $1.7 billion that was achieved in November 2021 because of the surge in the market.

Huge Commitment to Developing Mining Infrastructure

In 2023, a significant accomplishment was reached in the average monthly hash rate, exceeding 500 EH/s for the very first time. The substantial increase in hash rate suggests a considerable amount of capital has been allocated to the mining industry.

It is estimated that approximately $5 billion was allocated to investments in hardware, which led to a significant increase in the network hash rate. Between the fourth quarters of 2022 and 2023, the hash rate increased from 250 EH/s to 507 EH/s. This investment was accompanied by a proportional increase in power capacity, which is estimated to be 5.5 gigawatts.

Freshly Updated Mining Documents

Major mining corporations achieved impressive results, as Marathon’s MaraPool mined 1,853 BTC from 221 blocks in December 2023, marking a significant rise from the 475 BTC mined in December 2022.

Additionally, Marathon Digital witnessed a remarkable increase of 18% month-over-month (MoM) in the average operational hash rate, which skyrocketed to 22.4 EH/s. There has been a significant increase in mining capacity and efficiency, as indicated by this.

Increasing Financial Gains and Capital Allocation

During 2023, miners experienced a significant surge in their daily earnings from transaction fees, with an impressive fourfold rise. This translated to a staggering amount of around $2 million per day.

In November 2023, BTC miners were the recipients of significant venture capital investments, as stated in a recent report by Messari. Of the 98 deals related to cryptocurrency during that month, an overwhelming majority of approximately 90%, amounting to a staggering $1.75 billion, were explicitly targeted at Bitcoin miners.

The increase in profitability had a significant impact on the market dynamics of Bitcoin. It led to a decrease in the willingness of miners to sell their holdings, resulting in a reduction of selling pressure on Bitcoin.

How Did the Leading Cryptocurrency Mining Companies Fare in the Year 2023?

Bitdeer (BTDR)

Bitdeer’s performance in December 2023 was quite remarkable, generating a total of 434 BTC, which represents an impressive 149.4% growth compared to December 2022.

Despite the retirement of 6,000 older mining machines, there was a significant increase in productivity, even with a decrease in operational hash rate to 6.7 EH/s.

The company has ambitious plans for the future, which involve building a 175MW submerged cooling computing facility in Norway and a 221MW information center in Ohio. These projects are expected to be finished by 2025.

Hive Digital (HIVE)

In December 2023, Hive Digital encountered a minor decrease in their daily mining rate, resulting in the extraction of a sum of 282.8 Bitcoin, equivalent to an average rate of 9.1 BTC per day.

Nevertheless, their earnings from self-mining saw a notable 15% surge to $12 million in December, fueled by increased Bitcoin incentives and a rise in the value of Bitcoin.

Hive Digital offloaded 203 Bitcoin, accounting for a significant 72% of their monthly output, and bolstered their “hold” with an additional 80 BTC, resulting in a total of 1,707 BTC valued at a staggering $72.1 million as of the conclusion of December.

Riot Platform (RIOT)

In December 2023, Riot Platforms experienced a surge in production, generating a total of 619 Bitcoin with a daily output of 20 BTC. This represents a significant 35% growth compared to the previous month of November.

Despite an improved showing in December, the company’s utilization rate stood at 69%, prompting inquiries into its comparatively weaker mining performance in relation to competitors.

Riot Platforms is also making progress on the expansion of its Corsicana Facility in Texas, with the goal of increasing its self-mining hashing rate to 28 EH/s by the end of 2024.

Core Scientific (CORZQ)

Core Scientific had an incredibly successful 2023, producing an impressive 1,177 Bitcoin in December 2023 alone and a total of 13,762 Bitcoin throughout the entire year.

This was accomplished by significantly boosting the operational hash rate to an impressive 16.9 EH/s. In December, their revenue skyrocketed to $49.7 million, marking a significant 38% surge compared to November. This remarkable growth can be attributed to the improved mining rewards and the upward trend in the price of Bitcoin.

The Major Players in the Cryptocurrency Mining Industry Are Getting Ready for a Halving in 2024

The issuance of spot Bitcoin ETFs by the SEC on Jan. 10 has the potential to have a substantial impact on the market dynamics of Bitcoin.

Larry Fink, the CEO of BlackRock, emphasized the significant impact of Bitcoin ETFs on the finance industry, signaling a strong interest from traditional financial sectors.

Furthermore, this advancement has the potential to bring a significant amount of funds to the market for Bitcoin. Experts foresee a substantial influx of funds, ranging from $50 to $100 billion, pouring into Bitcoin exchange-traded funds (ETFs) in the United States. This influx has the potential to boost the market value of BTC.

In relation to Bitcoin mining, a rise in the market value of Bitcoin, driven in part by the influx of funds from ETFs, has the potential to enhance the profitability of miners.

Because of this, it is of utmost significance that the Bitcoin mining community is getting ready for the halving event that will take place in 2024. This event will reduce the reward for each block from 6.25 Bitcoins to 3.125 Bitcoins.

There has been a correlation between halving events, which are events in which the supply growth of Bitcoin is reduced, and an upward trend in the price of Bitcoin in the past.

In preparation for the upcoming halving of the Bitcoin supply in 2024, miners are making adjustments to their strategic plans. Upgrading to the most recent and cutting-edge mining hardware, such as the Antminer S19 XP, is one of the essential steps that must be taken in order to maximize the effectiveness of the hash rate.

Furthermore, they are making investments in sustainable and more affordable energy sources, which are essential for maintaining profitability in light of decreasing block rewards.

In addition, miners are establishing financial security by accumulating cash reserves and expanding into computing technology and cloud services. This strategic move guarantees both financial stability and working resilience, even in the midst of declining mining rewards.