Bitcoin has demonstrated a significant upward trajectory in value over recent weeks, surpassing the notable threshold of $40,000 and attaining its most considerable value since April 2022. The upward trajectory can be attributed to a significant surge in demand from investors based in the United States, as indicated by a favorable Coinbase premium.

According to expert analysis, the projected future milestone for the prominent cryptocurrency is anticipated to surpass the threshold of $50,000.

BTC Aims to Achieve $50,000 to $53,000

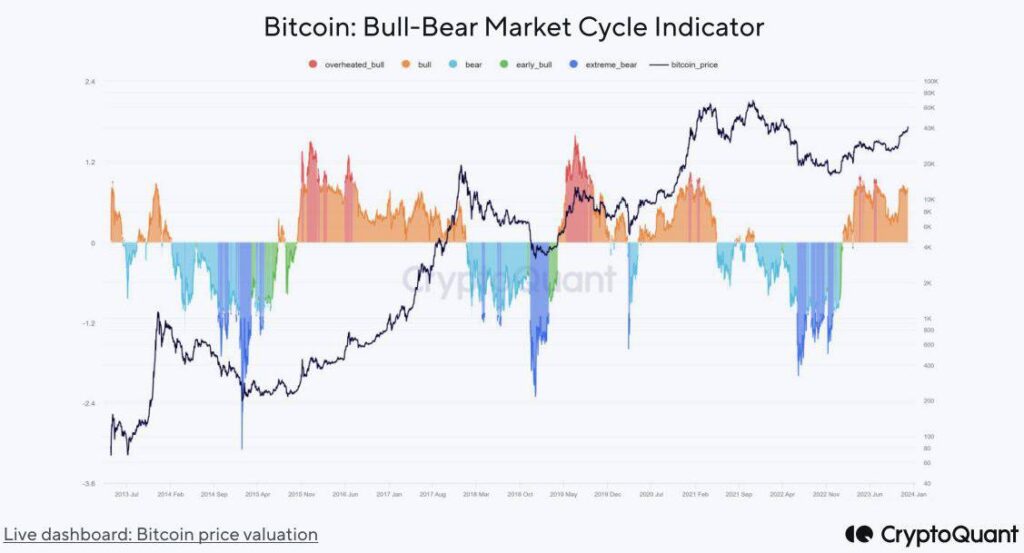

Based on the most recent report provided by CryptoQuant, an analysis of network activity suggests the possibility of a price target within the range of $50,000 to $53,000, considering the present value of Bitcoin at $43,000. Upon careful examination of the extended temporal horizon, it is observed that the digital currency Bull-Bear Market Phase Marker, as manifested by the crypto intelligence platform, conveys a discernible inclination toward a market characterized by bullish tendencies.

Furthermore, the prevailing positive sentiment is further bolstered by the lack of liquidity among retail traders and an unprecedented accumulation of BTC holdings exceeding a year. The observation above indicates a potentially favorable trajectory for the price movement of Bitcoin in the years to come.

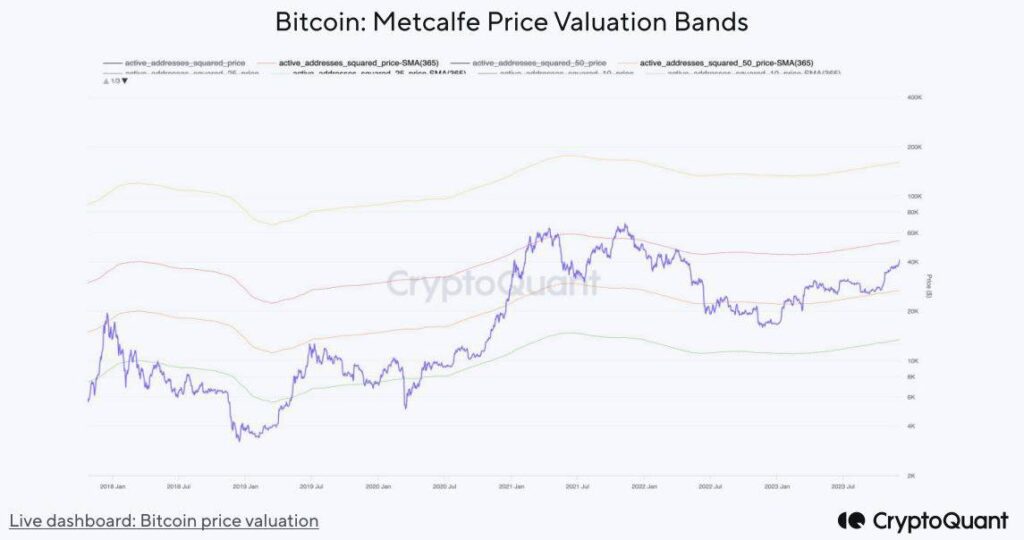

According to CryptoQuant’s recent analysis, it has been observed that Bitcoin may potentially target the valuation range of $50,000 to $53,000. This projection is based on an assessment of network activity.

The thresholds above pertain to the red Metcalfe Cost Assessment Band, which serves as an evaluative measure for the value of Bitcoin about user activity, more specifically, active addresses. The band above functioned as a notable resistance threshold for Bitcoin during April and November 2021 and again in April 2022.

The Bull Run For Bitcoin Is Still a Long Way From Its Peak

The potential for a temporary correction persists, considering the heightened rate of funding and the prevailing circumstance wherein 86% of the total moving supply currently demonstrates profitability. It is pertinent to acknowledge that, from a historical perspective, these levels have frequently correlated with local market peaks.

While it is prudent for traders to exercise caution given the current circumstances, a comprehensive analysis of the future outlook reveals a bullish indication emanating via the bitcoin Bull-Bear Economic Cycle Marker.

Acknowledging that the trend line is approaching the Overheated Bull stage (red region), a historical association that may indicate a temporary cessation of a market rally or a corrective movement.

The report elucidates that the current state of the cryptocurrency market indicates that it has yet to reach the pinnacle of its ongoing bullish trend. This assertion is based on the observation that prominent investors, commonly called whales, will likely exploit their gains due to the need for adequate liquidity for retail traders to exit their positions.

In a broader context, the scarcity of liquidity originating from retail traders, combined with the presence of Bitcoins reaching an unprecedented all-time high and remaining dormant for a period exceeding one year, culminates in a cheerful and optimistic perspective regarding the future trajectory of Bitcoin’s price dynamics.