Ethereum (ETH) has experienced a significant surge, reaching its annual peak and prompting speculation among investors and analysts about the possibility of attaining a price of $3,000.

Several elements have contributed to the current surge in price, such as the recent increase in staked Ethereum’s realized value surpassing $2,000, the growing deflationary trend, and the decreasing premium gap in Grayscale Ethereum Trust.

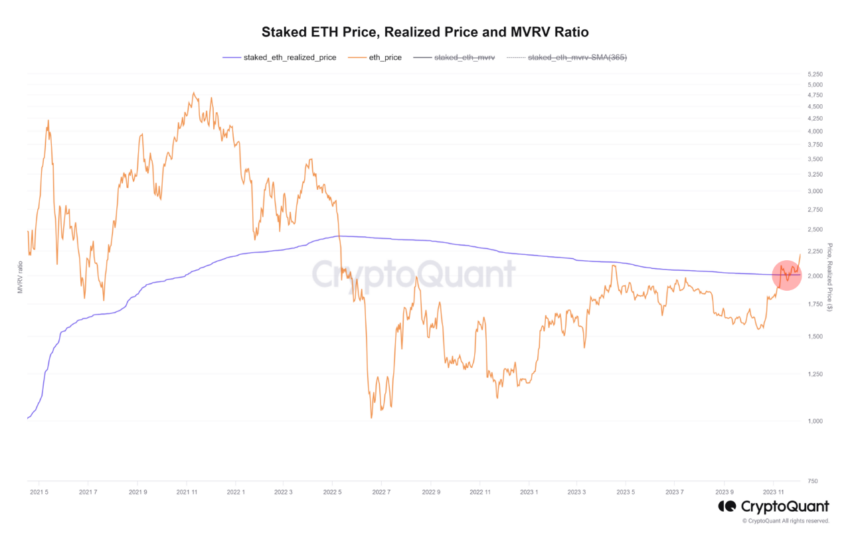

The Average Unit Price of Staked Ethereum (ETH) Breaks $2,000

As per the Director of Investigation at CryptoQuant, the mean value of ETH established on the Ethereum network has recently surpassed the $2,000 threshold. The observation was made.

The recent surge in the average unit price of ETH for long-term investors surpassing $2k has resulted in significant profitability for many investors. This development is expected to be a crucial future support factor.

The Realized Price of Staked Ethereum

The fact that this breakthrough occurred suggests that most long-term investors have now created a profit, which might provide a solid foundation for further expansion.

The Price of ETH is Going Up Because of the Blackrock ETF and More Institutional Interest

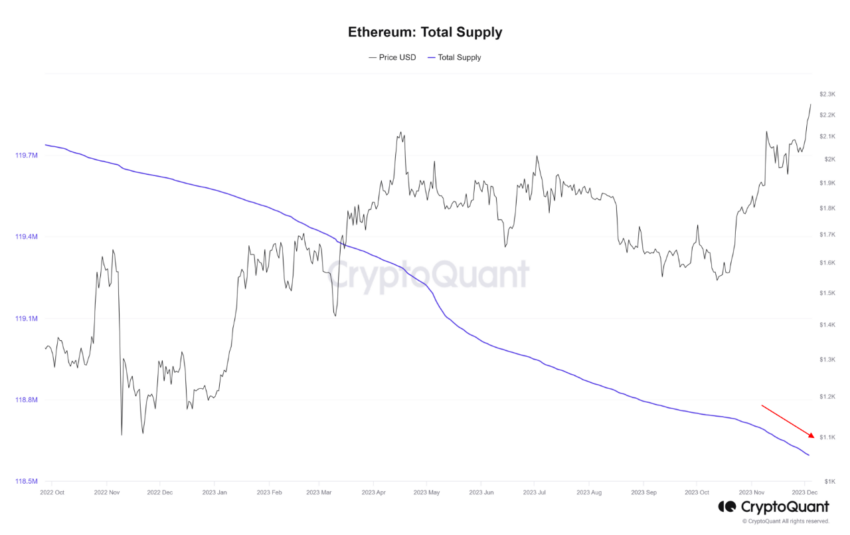

The enhancing inflationary phenomenon further contributes to the increase in Ethereum’s price. After BlackRock submitted an ETF application to the SEC on November 10, there was a noticeable increase in the overall volume of ETH transactions as the incinerated fees increased. This phenomenon has resulted in a significant decrease in the overall quantity of ETH available. Since the announcement was made public, the total supply has decreased by -82,861 ETH.

A Complete Supply of Ethereum (ETH)

Additionally, the disparity in the premium of Grayscale Ethereum Trust, which had decreased to -59.49% in December ’22, is gradually diminishing due to institutional purchases. The surge in ETH can be attributed to institutional investors’ significant purchase of trust products.

Brazil’s Itau Unibanco Joins Cryptocurrency, Which Helps More People Use Ethereum

The rise of institutional participation in Ethereum is poised for growth as Brazil’s leading bank, Itau Unibanco, introduces a cryptocurrency trading platform. Initially, the bank provides Bitcoin and Ethereum as options, with plans to include additional cryptocurrencies in its portfolio down the line. The nation’s crypto regulation outcome will be influenced by its ongoing development.

This action places Itau in direct rivalry with other domestic entities like crypto exchange MB, investment bank BTG Pactual’s digital assets unit Mynt, and international behemoths such as Binance.

A Top Ripple Lawyer Supports Bitcoin and Ethereum in the Face of Regulatory Uncertainty

In a surprising turn of events, lawyer John E. Deaton, renowned for participating in the Ripple vs. SEC legal battle, disclosed that his cryptocurrency portfolio predominantly consists of Bitcoin and Ethereum. Deaton made a statement on X.

At the time [when the SEC filed suit], the user owned three tokens, and XRP was their most minor expenditure behind BTC and ETH.

The manifestation suggests that investors have a sense of trust towards these assets, even amid uncertainties surrounding regulations.

Ten-Week High in the Flow of Digital Assets, Led by Bitcoin and Ethereum

In the past week, there was a total of $176 million in digital asset inflows, with Bitcoin and Ethereum taking the lead. According to CoinShares, there has been a significant increase in value, reaching a peak not seen in the past ten weeks since October 2021. This suggests increasing investor enthusiasm and investment in these digital currencies.

Ethereum experienced an additional $31 million in inflows during the previous week, resulting in $134 million over five weeks. Notably, net flows have turned positive at $10 million, marking the first occurrence of this phenomenon in the current year.

As Ethereum maintains its upward movement, driven by a powerful combination of on-chain factors, institutional attention, and optimistic investor sentiment, achieving the $3,000 price level is more a matter of timing rather than uncertainty.