Following a remarkable performance in the initial half of 2023, the price of Bitcoin (BTC) has encountered a period of stagnation, finding itself confined within the boundaries of $29,000 and $31,500.

There is a possibility that, within the foreseeable future, the price of Bitcoin could trade in a lateral direction or experience a decline. The thesis can be structured around three key factors: two elements centered on technical analysis and a third factor focused on fundamentals.

The $32,000 Price Point Has Been a Strong Point of Support for Bitcoin

Capriole Investments’ founder, Charles Edwards, has recently shared a market update highlighting the noteworthy resistance that Bitcoin has encountered in its attempts to surpass the $31,000 to $32,000 range.

Bitcoin finds itself at a crucial juncture as it encounters formidable resistance at the chart’s prominent level of $32K. Amidst a series of encouraging developments within the crypto realm, including the Blackrock ETF revelation, the favorable outcome of the XRP legal battle, and even presidential hopeful Kennedy’s endorsement of backing the US Dollar with Bitcoin, Bitcoin itself has struggled to maintain its upward trajectory beyond the $31K mark

The report suggests that if significant positive news fails to generate an upward price movement, it may serve as a bearish signal.

Analysts Question the Potential Sustainability of the $29,500 Support Level for Bitcoin

Recently, Bitcoin has maintained a trading range above the $30,000 threshold, with minimal deviations below. However, the absence of substantial support below $29,500 suggests a potential breach from the ongoing consolidation may result in additional downward movement.

According to a prominent crypto market commentator, Colin Talks Crypto, it has been observed that the upcoming significant support levels for the BTC/USD pair are anticipated to manifest around the approximate price point of $27,500. The observed level demonstrates support by historical price movements, while the convergence of the 200-week MA and the 200-day MA is occurring nearby the below-said level.

“#Bitcoin appears to exhibit a reasonable probability of descending towards the approximate value of $27.3k, where a convergence of factors is observed:

1. A robust backing range of prior price movement (orange rectangle)

2. Where the 200-weekly moving average (pink) functions as a supportive level.

3. The 200-day moving average (blue) is also nearby.”

— Colin Talks Crypto (@ColinTCrypto)

Over the previous month, the BTC/USD pair has exhibited a sustained period of consolidation characterized by a narrow range of price movements. Support for this particular range materializes near the $29,500 threshold. A potential scenario involves a daily closure below a significant support level, potentially paving the way for a subsequent downward movement toward the price point of $27,500.

Nevertheless, there has been a noticeable decrease in volumes, indicating that the recent downward surge may possess a less bearish nature than initially perceived. In the event of an increase in trading volume during a potential market correction, the bears can assert dominance.

BTC/USD 1-day chart. Source: TradingView

The Foundations of the Bitcoin Network Have Been Struggling

The report above by Capriole Investments underscores the notion that “price merely constitutes a fraction of the overall equation.” Fundamental factors, too, make their presence felt. Among the metrics most worthy of consideration are those that pertain to inquiries such as:

- The current state of on-chain flows is a topic of interest.

- The allocation of capital by investors is a subject of interest.

- The interplay between general market sentiment and the macro environment has a profound influence on the trajectory of Bitcoin.

- The growth of network security is becoming increasingly apparent in contemporary times.

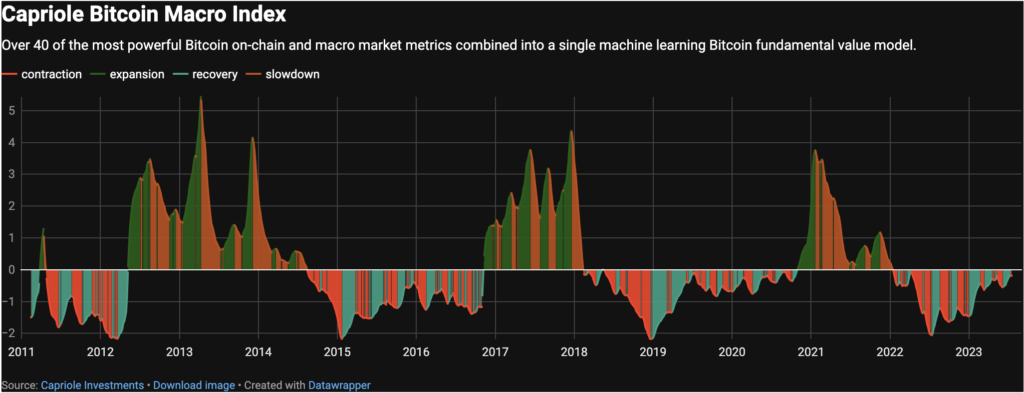

The Capriole Bitcoin Macro Index comprises a comprehensive assessment of 40 distinct fundamental Bitcoin factors, encompassing on-chain metrics, macroeconomic indicators, and equity market metrics. The amalgamation of various factors has culminated in creating a unified machine-learning model.

The analysis reaches its final determination:

“The Macro Index currently resides within a phase of relative value (below zero), indicating a favorable long-term value for investors with a multi-year outlook. In a recent development, the Index has again entered a contraction phase. The on-chain and macro fundamentals have initiated a downward trajectory after a 7-week phase of recovery that commenced at $26K during the initial days of June.”

Capriole Bitcoin Macro Index. Source: Capriole Investments

The Bullish Case for Bitcoin’s Price Over the Long Run Is Still Relevant

Amidst these imminent bearish developments, one may find little cause for long-term apprehension. The upcoming halving event is approaching within a year, accompanied by a continuous influx of positive results.

In a remarkable development, the hash rate has experienced a staggering 50% surge within six months. The observation above implies that the network of Bitcoin is currently exhibiting unprecedented strength and displaying an exponential growth trajectory.

The content presented in this article does not constitute any form of investment advice or recommendations. All investment and trading endeavors carry inherent risks, and it is advisable for readers to independently conduct thorough research before making any decisions.